Multi vendor marketplaces are no longer just a business model; they’ve become the channel buyers prefer, sellers depend on, and enterprise brands invest in. With marketplaces projected to drive over 60% of global retail ecommerce revenue by 2025, their growth is clearly outpacing traditional ecommerce.

For enterprises, this shift hasn’t happened overnight. Large brands have long understood that multi vendor marketplace platforms unlock something that standalone ecommerce cannot, i.e; the compounding, network-driven growth. More sellers bring more choice, better pricing, and faster expansion into new categories and regions. Over time, this creates momentum that single-brand online stores struggle to replicate.

But as retail and B2B marketplaces mature and buyer expectations change with changing 2026 ecommerce trends, the marketplace playbook also begins to diverge from what worked before. The most successful marketplaces are no longer defined by size alone, but by how intelligently they connect buyers, sellers, and operations, and how quickly they adapt as expectations evolve.

Table of Contents

- Why Multi Vendor Marketplaces Are Growing Faster Than Ecommerce

- 10 Multi-Vendor Marketplace Trends Shaping 2026

- 1. Multi-Model Marketplaces Become the Enterprise Default

- 2. AI-Native Marketplace Software Changes the Playbook

- 3. AI-Powered Discovery Replaces Static Marketplace Search

- 4. Omnichannel Marketplace Presence Expands Beyond Websites and Apps

- 5. Agility and Integration Become Marketplace Differentiators

- 6. Seller Experience Becomes a Growth Lever, Not an Afterthought

- 7. Dealer- and Partner-Powered Marketplaces Scale Faster Than Centralised Models

- 8. Unified Inventory Across Sellers and Channels Becomes Non-Negotiable

- 9. Marketplace Fulfilment Goes Distributed and Hyperlocal

- 10. Localisation Becomes the Key to Global Marketplace Success

- How StoreHippo’s Multi Vendor Marketplace Platform Helps Enterprises Adopt Ecommerce Trends 2026

- Conclusion: The Enterprise Multi Vendor Marketplace Playbook for 2026

- FAQ

Why Multi Vendor Marketplaces Are Growing Faster Than Ecommerce

Ecommerce trends for 2026 clearly underline the fact that buyers love shopping on online marketplaces where they get a wider choice, better pricing, and easier comparisons to make better, faster and informed decisions.

Here are the top multi vendor marketplace insights on how this model is driving both B2C and B2B growth:

Multi Vendor Marketplace Growth Trends

- #1 Online marketplaces are forecasted to be the largest and fastest-growing retail channel worldwide by 2027 (Source: Technavio – B2B Ecommerce Market Analysis)

- 59% of global ecommerce sales are projected to come from online marketplaces by 2027 (Source: Enterprise Times)

- 62% of global B2C ecommerce sales already flow through online marketplaces

(Source: ClickPost) - 48–56% of buyers prefer starting their online shopping journey directly on a marketplace website (Source: ResearchGate)

- 75%+ of global B2B procurement spending is projected to happen through online marketplaces (Source: IoT Analytics)

Multi vendor marketplaces are growing faster because they align naturally with how modern buyers make buying decisions across both B2C and B2B contexts. For enterprises in 2026, enterprise marketplace brands need to decide how well their business is designed to scale, adapt, and deliver consistent value at every touchpoint.

With the changing ecommerce trends 2026, marketplace success is less about rapid expansion and more about intelligent execution, guiding discovery, enabling confident decisions, and scaling complexity without chaos. AI is the force reshaping this new marketplace playbook.

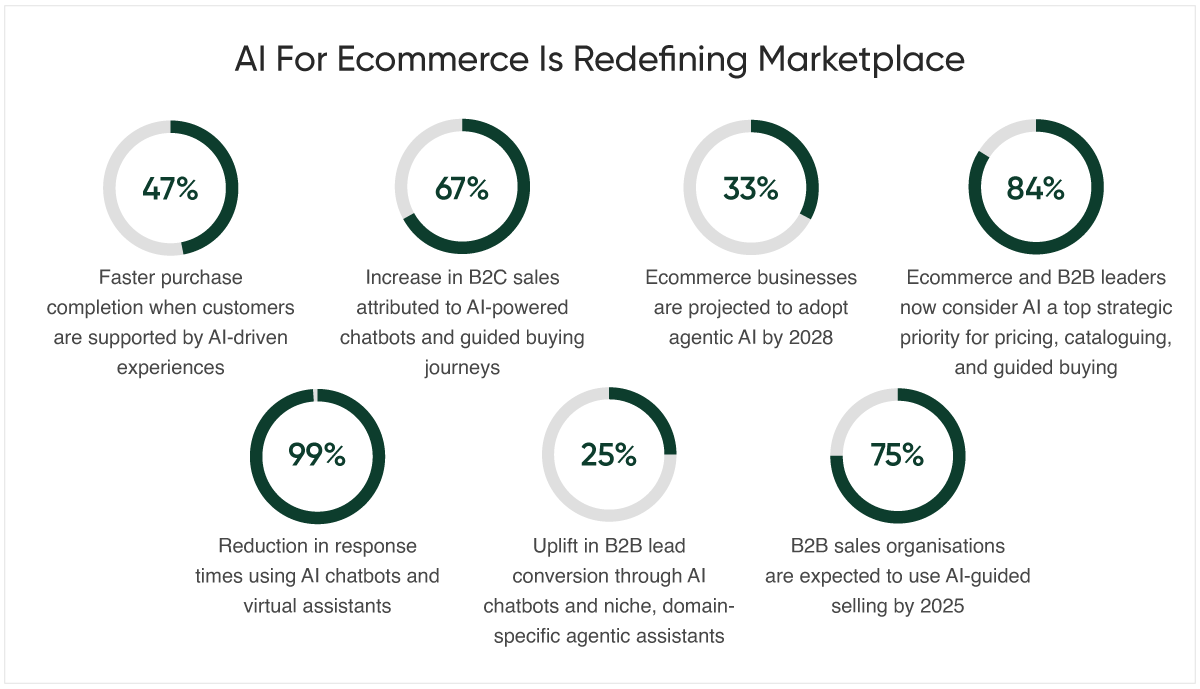

How AI For Ecommerce Is Redefining Marketplace Playbook In 2026

- 47% faster purchase completion when customers are supported by AI-driven experiences (Source: Bain & Co., Finextra)

- 67% increase in B2C sales attributed to AI-powered chatbots and guided buying journeys (Source: Digital Commerce 360)

- 33% of ecommerce businesses are projected to adopt agentic AI by 2028

(Source: Kodif AI) - 84% of ecommerce and B2B leaders now consider AI a top strategic priority for pricing, cataloguing, and guided buying

(Source: Citrusbug, Statista) - 99% reduction in response times using AI chatbots and virtual assistants

(Source: Accel Partners, Pearl Organisation) - 25% uplift in B2B lead conversion through AI chatbots and niche, domain-specific agentic assistants (Source: Bain & Co., Digital Commerce 360)

- 75% of B2B sales organisations are expected to use AI-guided selling by 2025

(Source: Statista, Finextra)

AI is fundamentally improving how marketplaces operate, turning complexity into coordinated, scalable growth. It enables enterprises to guide buyers more effectively, support sellers at scale, and make faster decisions without adding operational overhead. These shifts are now crystallising into a new set of multi vendor marketplace ecommerce trends for 2026 that will define how enterprise marketplaces are built, operated and scaled.

10 Multi-Vendor Marketplace Trends Shaping 2026

Enterprise marketplaces are entering a new phase of maturity. Growth is no longer driven by size alone, but by intelligence, flexibility, and operational efficiency.

The following trends outline what enterprise brands must prioritise to build future-ready multi-vendor marketplaces in 2026.

1. Multi-Model Marketplaces Become the Enterprise Default

In 2026, leading enterprises are no longer running marketplaces on a single model. Instead, the multi vendor marketplace is evolving into a multi-model commerce engine, combining B2B with D2C, B2C with hyperlocal, D2C with service provider partner-based selling or quick commerce with local retail shops as vendors. And such hybrid, out-of-the-box marketplace models are operating from a single platform.

This shift is driven by how enterprises now grow. Launching one model at a time is slow and limiting. Brands want to serve wholesalers, distributors, direct consumers, and partners simultaneously without duplicating platforms, teams, or inventory. Modern enterprises planning disruptive growth need multi vendor marketplace platform that allows them to run these models in parallel, with shared data, unified inventory, and coordinated workflows.

These platforms should be capable of natively handling the marketplace app or website across different models and also pivot to new hybrid models without heavy customisation or plugin dependency. Enterprises that build multi-model marketplaces gain better customer reach, diversified revenue streams, and the ability to respond faster to market shifts without slowing down operations.

Why it matters:

Multi-model marketplaces allow enterprises to scale in parallel instead of sequentially, turning the marketplace into a long-term growth engine rather than a single-use channel.

Why it matters:

Growth now happens across models at the same time, not through sequential launches and marketplaces that support this flexibility become long-term growth engines rather than a single-use channel.

2. AI-Native Marketplace Software Changes the Playbook

One of the most defining ecommerce trends 2026 is how intelligence is moving from the edges of the system into the core of the marketplace setup. Enterprises are no longer experimenting with AI as a layer on top of existing stacks. They are redesigning how the multi vendor marketplace itself operates.

Traditional marketplace platforms rely on manual processes and bolt-on tools to manage cataloguing, seller onboarding and buyer experiences. At scale, this creates friction. AI-native marketplace software takes a different approach, automating these workflows continuously, so the system improves as it grows rather than becoming harder to manage.

This shift is especially visible in complex enterprise B2C and B2B environments, where product data, seller rules, and buyer journeys change frequently. When intelligence is built into the foundation, marketplaces stay consistent across channels and regions without constant intervention.

Why it matters:

As marketplaces scale, efficiency depends on intelligence, not effort. AI-native marketplace platforms allow enterprises to grow faster without adding operational drag or system complexity.

3. AI-Powered Discovery Replaces Static Marketplace Search

By 2026, the way buyers discover products inside a multi vendor marketplace is changing fundamentally. Filters, categories, and keyword-based search alone are no longer enough, especially as marketplaces grow larger and more complex.

Buyers now expect discovery to feel intuitive. They want the marketplace to understand intent, context, and preferences without forcing them to refine searches endlessly. This is where AI-powered discovery begins to replace static search logic. Instead of matching keywords, marketplaces guide buyers toward relevant products through smarter recommendations, conversational prompts, and real-time refinement.

This shift is even more important for large multi seller environments and B2B marketplaces, where product catalogues can run into thousands of SKUs and decision-making is rarely linear. When discovery becomes intelligent, buyers find what they need faster, sellers gain better visibility, and conversion improves without increasing marketing spend.

Why it matters:

As choice expands, discovery becomes the real differentiator for multi vendor marketplace success. In 2026 and beyond, online marketplaces that help buyers navigate complexity effortlessly will convert better and retain users longer than those relying on traditional search alone.

4. Omnichannel Marketplace Presence Expands Beyond Websites and Apps

In 2026, successful marketplaces are no longer confined to a website or a single marketplace app. Buyers move fluidly between channels, browsing on mobile, interacting with brands on chat, completing purchases through messaging apps, or returning via notifications. Marketplace brands that are present where buyers already are see fewer drop-offs and higher conversions.

This shift goes beyond being “present everywhere.” What matters is consistency. Pricing, inventory, order status, and support must stay aligned across touchpoints. When channels operate in silos, the experience breaks. When they’re connected on every touchpoint of the multi vendor marketplace platform, buying feels faster, simpler, and more reliable.

For enterprises, omnichannel presence also opens new growth paths. AI powered chat interfaces, social commerce, and assisted journeys work especially well for repeat purchases, high-consideration products, and B2B reorders without forcing buyers back into long checkout flows.

Why it matters:

As ecommerce trends 2026 push toward convenience and speed, marketplaces that unify buyer journeys across channels will see higher engagement, repeat purchases, and higher lifetime value without multiplying systems or operational effort.

5. Agility and Integration Become Marketplace Differentiators

By 2026, marketplace growth is less about adding more features and more about how quickly a multi vendor marketplace platform can adapt. New seller types, new fulfilment models, new pricing rules, or regional expansions shouldn’t require long rebuilds or heavy rework.

Enterprises are increasingly choosing marketplace software that allows them to change workflows, integrate systems, and launch new capabilities without disrupting what’s already live. Rigid platforms slow experimentation. Flexible ones let teams respond to market shifts in weeks instead of quarters.

This agility also applies to integrations. Marketplaces must connect smoothly with ERPs, CRMs, payment, logistics, marketing and analytics systems without creating brittle dependencies. When integrations are so seamless that they feel like a native capability rather than a custom project, marketplaces scale with confidence instead of caution.

Why it matters:

In fast-moving markets, speed of adaptation becomes a competitive advantage. Multi vendor marketplaces platforms that stay agile can test, evolve, and expand faster while others struggle to keep up with changing buyer and seller expectations.

6. Seller Experience Becomes a Growth Lever, Not an Afterthought

In 2026, the success of a multi vendor marketplace is directly tied to how easy it is for sellers to join, operate, and grow on the platform. Enterprises are realising that commission structures alone don’t drive seller loyalty, seller experience does.

High-performing marketplaces should focus on faster onboarding, clear workflows, and real-time visibility into orders, payouts, and performance. When sellers can manage listings, inventory, and fulfilment without friction, overall marketplace reliability improves automatically.

Ecommerce trends 2026 also show enterprises moving towards AI assisted and semi-automated seller operations to reduce support load and improving consistency. This shift helps marketplaces scale seller networks without scaling teams to manage operational chaos.

Why it matters:

A better seller experience leads to better assortment, faster fulfilment, and more reliable buyer experiences, creating a flywheel effect that drives marketplace growth from the inside out.

7. Dealer- and Partner-Powered Marketplaces Scale Faster Than Centralised Models

In 2026, enterprises are rethinking how marketplaces scale fulfilment and reach. Instead of relying only on central warehouses or dark stores, many are turning existing dealer, distributor, and partner networks into active sellers and fulfilment nodes within their marketplace ecosystem.

This approach allows a multi vendor marketplace to expand faster without heavy capital investment. Dealers already understand local demand, operate closer to buyers, and can fulfil orders quicker than centralised models. For enterprises, this means faster delivery, lower logistics costs, and stronger partner relationships all without building new infrastructure upfront.

It also aligns naturally with B2B and hybrid commerce, where partner-led selling has always been part of the value chain.

Why it matters:

Marketplaces that leverage partner networks scale reach and speed simultaneously, while centralised-only models struggle to balance cost, coverage, and delivery expectations.

8. Unified Inventory Across Sellers and Channels Becomes Non-Negotiable

As marketplaces grow, fragmented inventory is one of the fastest ways to break buyer trust. In 2026, enterprises can no longer afford separate stock views for sellers, brand-owned stores, offline locations, and other marketplace touchpoints like apps, agentic chat interface etc.

Modern multi vendor marketplace platforms are moving toward unified, real-time inventory visibility where availability updates instantly across seller stores, marketplace apps, and physical fulfilment points. This reduces overselling, prevents cancellations, and enables smarter fulfilment decisions based on proximity and availability.

For enterprises operating across regions or business models, unified inventory also becomes the backbone for faster delivery and better customer experience.

Why it matters:

Consistent inventory visibility is not just an ecommerce trend 2026, it is foundational to scale. Without it, even well-designed marketplaces websites struggle to deliver reliability at enterprise volumes.

9. Marketplace Fulfilment Goes Distributed and Hyperlocal

By 2026, marketplace fulfilment is moving away from centralised warehouses toward distributed, seller-powered, and partner-led fulfilment models. Enterprises are designing marketplaces where orders are fulfilled from the nearest capable seller, dealer, or partner, reducing delivery times without increasing infrastructure costs.

This shift allows a multi vendor marketplace to meet rising speed expectations while staying cost-efficient. Instead of building new logistics layers, enterprises leverage existing local networks and route orders intelligently based on location, availability, and delivery capacity.

Distributed fulfilment also supports same-day and next-day delivery models in urban and semi-urban markets, where buyer expectations are highest.

Why it matters:

Hyperlocal fulfilment improves speed and reliability without the heavy overhead of centralised operations making it one of the most scalable fulfilment strategies for enterprise multi vendor marketplace platforms.

10. Localisation Becomes the Key to Global Marketplace Success

In 2026, global marketplace expansion is no longer about launching one international site and hoping it works everywhere. Enterprises are succeeding by building marketplaces that feel local in every region, while remaining centrally governed.

Multi vendor marketplace platforms that support local languages, currencies, pricing rules, taxes, and fulfilment logic without duplicating systems will have a clear competitive edge. This level of localisation enables seamless cross-border selling by allowing brands to onboard local sellers, offer frictionless payments in native currencies, and help buyers make informed decisions through region-specific, language-native product experiences. Throughout this expansion, enterprises retain full visibility and central control across markets from a single backend.

This balance between global scale and local relevance is what separates high-performing marketplaces from those that stall after initial expansion.

Why it matters:

Global growth without localisation fails to convert. Multi vendor marketplaces that adapt to regional buying behaviour scale faster, build trust quicker, and sustain long-term expansion.

How StoreHippo’s Multi Vendor Marketplace Platform Helps Enterprises Adopt Ecommerce Trends 2026

As ecommerce trends 2026 push enterprises toward scale, speed, and intelligence, the difference lies in whether the marketplace platform is built natively for handling complexity and scale or patched together over time.

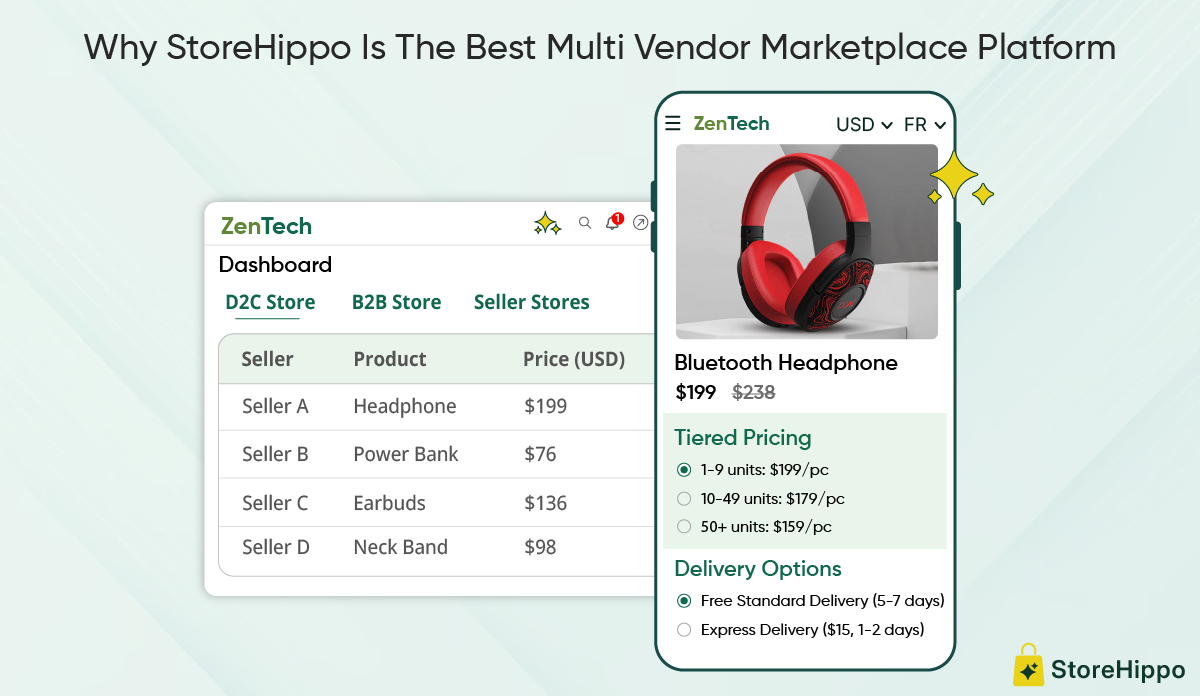

StoreHippo’s multi vendor marketplace platform is designed as a unified, white-labelled enterprise foundation, not a plugin-led setup. This allows enterprises to launch, operate, and scale marketplaces without integration debt, fragmented data, or operational drag.

The SaaS-based, AI-native marketplace platform StoreHippo comes with native multi-vendor, multi-model, and multi-store capabilities, and 300+ enterprise grade features, enabling enterprises to implement modern marketplace trends without rebuilding their core for every new requirement. Instead of managing tools, teams orchestrate growth from sellers and buyers to fulfilment and intelligence from one platdorm.

How StoreHippo enables enterprises to implement key marketplace trends of 2026:

- Native Multi Vendor Marketplace Support

Enterprises can launch and scale complex multi vendor marketplaces without plugins, in record time, ensuring clean data flows and predictable performance at enterprise scale. - Multi-Model Marketplace Support (B2B, B2C, D2C, B2B2C)

Brands can run B2B marketplaces, retail marketplaces, and hybrid models B2B2C, hyperlocal, quick commerce etc from a single backend without duplicating systems. - AI-Powered Marketplace Operations

Built-in AI for ecommerce to automate marketplace workflows like, cataloguing, image edits, discovery, recommendations, assisted buying, seller supportcustom agentic solutions, all powered by a shared intelligence core. - Omnichannel Support

Headless architecture and inbuilt omnichannel support enable enterprises to operate a unified marketplace presence across web, marketplace apps, PWAs, WhatsApp, and AI-based conversational interfaces, ensuring consistent discovery, buying, and fulfilment experiences across every buyer touchpoint. - White-Labelled Marketplace Experiences

Enables brands to build white-labelled marketplace software with full brand control across marketplace websites and marketplace apps, seller stores, and regional storefronts. - Empowering Sellers With Tools

Self-service seller onboarding, dashboards, order management, fulfilment support and AI-assisted operations improve seller adoption and retention. - Unified Inventory and Order Management

Centralised master catalogue and real-time inventory visibility across sellers, channels, and fulfilment locations. - Dealer- and Partner-Led Marketplace Solutions

Onboard existing dealer and distributor networks as vendors and turn their infrastructure and fleet of delivery boys into hyperlocal fulfilment centres without upfront operational complexity and cost. - Pre-Integrated Fulfilment Support

30+ pre-integrated fulfilment partners, along with native delivery partner management, enables seller- and partner-powered fulfilment using either their own delivery networks or integrated logistics providers, without operational complexity. - Global-Ecommerce And Multi-Store Capabilities

StoreHippo multi vendor marketplace platform comes with built-in multi store and go global features enabling enterprises to launch region-specific marketplaces with local pricing and currencies, languages, taxes, and workflows managed from one backend. - Enterprise-Grade Integrations and Governance

The API-first architecture supports seamless ERP, CRM, marketing, logistics, and analytics integrations with central control. - Built-In Marketing Tools

Native marketing capabilities such as discounts engine, coupons, abandoned cart follow-ups, SEO tools, and dynamic landing pages allow enterprises to run targeted campaigns and drive conversions without relying on external plugins. - Enterprise-Grade Security and Compliance

Built with enterprise security standards including PCI DSS, SOC, and ISO compliance, along with audit logs, login based access, two step authentication etc, StoreHippo multi vendor marketplace platform ensures secure transactions, data protection, audit logs, and role-based access across marketplace operations.

By combining native marketplace capabilities with AI-powered intelligence and enterprise-grade scalability, StoreHippo enables brands to adopt ecommerce trends 2026 not as experiments but as coordinated, long-term growth strategies.

Conclusion: The Enterprise Multi Vendor Marketplace Playbook for 2026

In 2026, winning with a multi vendor marketplace will depend less on adding more products and geographies and more on how intelligently the marketplace runs end to end. The strongest marketplaces will be those that connect buyer discovery, seller workflows, fulfilment, and governance through one coordinated system so teams can scale faster without operational drag. As ecommerce trends 2026 push enterprises toward speed and adaptability, fragmented stacks will struggle to keep up across models and markets.

That’s why enterprises are moving toward a multi vendor marketplace platform built for unified scale where growth stays controlled, predictable, and efficient across channels, regions, and operations. StoreHippo multi vendor marketplace platform helps brands make that shift and build custom marketplace ecosystems that are designed to evolve.

Ready to align your marketplace app and marketplace strategy with the ecommerce trends of 2026? Scale smarter and faster with StoreHippo, book a demo now.

FAQ

1. When does it make sense for an enterprise to build a multi vendor marketplace instead of a traditional ecommerce store?

A multi vendor marketplace makes sense when growth depends on expanding assortment, onboarding partners or sellers, or scaling into new categories and regions faster than a single-brand store allows.

2. Can one multi vendor marketplace platform support both B2B and B2C use cases effectively?

Yes, provided the platform is designed for multi-model commerce. Enterprises increasingly run B2B and B2C marketplaces from a single backend with different pricing, workflows, and buyer journeys.

3. How important is AI for running a multi vendor marketplace at scale in 2026?

AI is becoming critical for managing discovery, catalog quality, seller operations, and buyer support at scale. Without AI, marketplaces struggle to maintain speed, relevance, and efficiency as complexity grows.

4. What are the biggest risks of using plugin-heavy marketplace software at enterprise scale?

Plugin-heavy setups often lead to fragmented data, slower go-to-market, performance issues, and high operational overhead making it harder to scale or adapt to changing marketplace demands.

5. How long does it typically take for an enterprise marketplace to go live and start scaling?

With a native, no-plugin marketplace platform, enterprises can launch faster and scale incrementally adding sellers, models, and regions without rebuilding the foundation each time.