Ecommerce has made it possible for the etailers to dream big and build a brand presence in the global markets. However, to turn this dream into reality, they need reliable, secure and the best international payment gateways that operate in multiple countries and acceptmulti-currency payments.

Frictionless checkouts go a long way in building a loyal customer base. Seamless cheakouts make the buyer experience memorable and keeps them coming for more. While there are a lot of secure and fast international payment gateways, choosing the one that enables you to offer an outstanding payment experience can be a bit tricky.

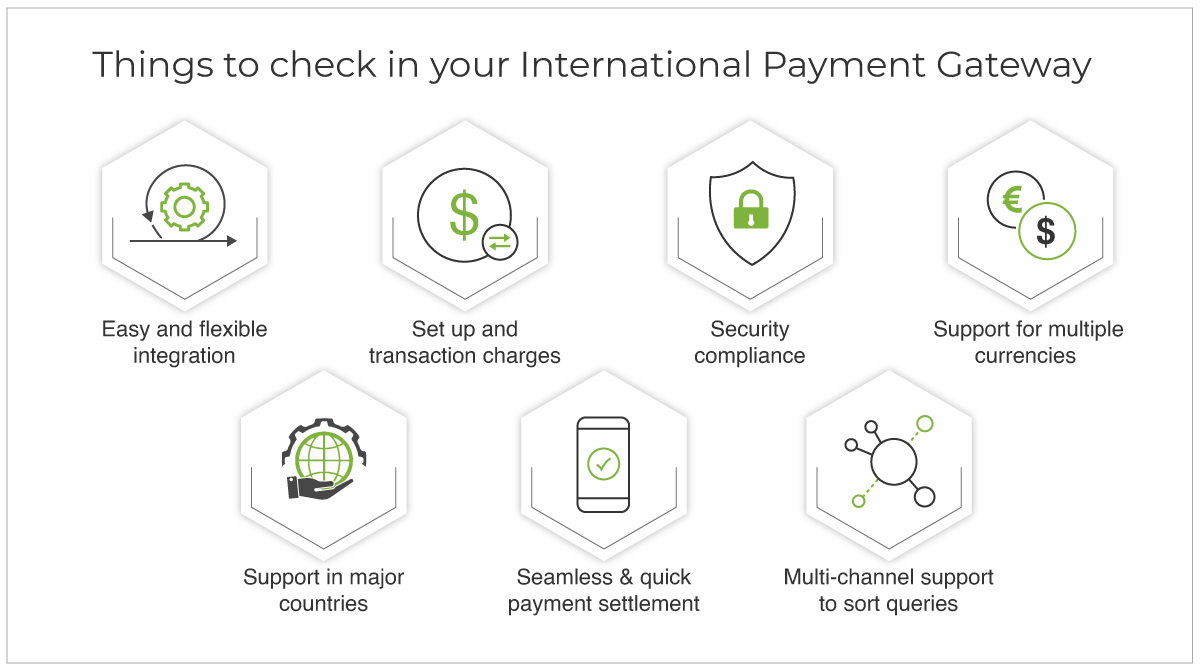

To choose the best-fit payment provider from the list of international payment gateways, you need to evaluate the payment processors thoroughly. The best payment channel depends on the type, volume and geography of your online business. However, the basic things you need to check in the international payment gateways are;

Easy and flexible integration

Set up and transaction charges

Security compliance

Support for multiple currencies

Support in major countries

Seamless and quick payment settlement

Multi-channel support to sort queries

Table of Contents

- List Of Top 11 International Payment Gateways For Global Ecommerce

- Paypal

- Verifone ( Formerly 2Checkout ( 2CO))

- Stripe

- Authorize.net

- ANZ

- Checkout.com

- Worldpay (Now known as FIS)

- Paytm Payment Gateway

- Telr

- HyperPay

- senangPay

- Pros

- Cons

- Fee And Charges

- senangPay international payment gateway has a different TDR rate for debit and credit cards transactions which is higher than the rate for net banking or FPX transactions and e-wallet payments. They are open to discussing lower/customized rates for businesses that think they deserve a lower TDR rate than stipulated.

- Conclusion

- International Payment Gateways FAQs

- 1) What is a Payment Gateway?

- 2) What is an international Payment Gateway?

- 3) How does a Payment Gateway work?

- 4) What are the different types of Payment Gateways?

- 5) What are the different Payment Gateway transaction terms and their meaning?

- 6) What are the charges of using a Payment Gateway?

- 7) What is a merchant account?

- 8) What is settlement time in Payment Gateway?

- 9) What is a PCI compliant Payment Gateway?

- 10) What are the benefits of using multiple Payment Gateways on your ecommerce website?

List Of Top 11 International Payment Gateways For Global Ecommerce

In our previous blog, we presented the payment gateway list of thetop 5 Indian payment systems. Now, We bring to you a list of the 11 best international gateways that can help you expand your business and take your brand to global markets. We have taken care to pick the payment channels that offer the easiest and low cost or free set up and offer wide coverage in terms of geography and currencies.

Let us analyse the relative benefits of the top contenders for payment gateways worldwide;

Paypal

Paypal is one of the oldest and most popular international payment gateways for online businesses. We have chosen it to begin our international payment gateway list as everyone has heard about it and can easily connect to Paypal as an international payment system.

Pros

Paypal has the largest number of active users and setting up a Paypal account is very easy. They have no setup fees and the structure for successful transaction charges is also very transparent. It is based on the volume of monthly transactions and merchants can claim discounts once they cross a certain monthly threshold.

Paypal payment gateway is available in almost all the major countries of the world. It integrates with an unbelievable number of shopping carts hence can be used by any business/ platform. Apart from regular payment transfers to Paypal accounts it also allows accepting link payments by sending links to your customers. Paypal can be accessed through the web page as well as mobile and iOS apps making it a good choice for omnichannel businesses.

Cons

High transaction charges

Customers are redirected from the merchant site to complete the payment

Fees And Charges

No set up fees or monthly charges

2.9% of transaction amount + currency based fixed fee for transactions within USA

4.4% of transaction amount + currency based fixed fee for transactions outside USA

1% for instant withdrawals of fund

Verifone ( Formerly 2Checkout ( 2CO))

Verifone ( formerly 2CO) is one of the most popular international payment gateways based in the USA.

Pros

It has no setup fees or monthly fees making it a good option during the start of the business. The rates are based on the home country and tied to each successful transaction. Verifone ( formerly 2CO) makes in the top 2 of the best international payment gateways list as it accepts payments from 200 countries across the globe. It supports multilingual checkout in 30+ languages, 100 currencies, using 45+ payment methods making it the first choice for merchants who really want to take their business global.

The integration is flexible and can be easily done for over 100 types of shopping carts. Other advantages include recurring billing, advanced fraud protection and mobile optimization which helps customers in device-independent shopping. Customers who process a large volume of transactions through Verifone international payment gateway can get specific custom discounts.

Cons

Some merchants have reported delayed or held payments

Prohibited products list is very long making it unviable many businesses

Fees And Charges

3 different plans:

2Sell Plan ( For accepting mobile and online payments from global buyers): 3.5% of transaction amount + $0.35 per transaction

2Subscribe Plan ( For accepting recurring subscription payments globally): 4.5% + $0.45/transaction for standard payments.

2Monetize Plan ( For accepting digital goods payments worldwide): 6.0% + $0.6/ transaction for standard payments.

Stripe

Stripe is one of the top contenders in the international payment gateways list with its cloud-native payment method and range of APIs to integrate new payment options for worldwide transactions.

Pros

With ZERO setup cost, monthly fees or any other hidden charges Stripe is one of the best online payment solutions of global businesses. It works on the pay as you go model and is good for businesses that are starting small but plan to scale up in the near future.

Stripe international payment gateway is very easy to integrate and offers plenty of tools that make it work with almost any type of cart or platform. The flexibility of the Stripe platform makes it an ideal candidate for customised payment needs as per the business requirements.

Stripe qualifies as the best international payment gateway for the Ecommerce industry as it supports simple checkout for debit and credit card processing. It also offers simple payment solutions for multi-channel payments, online marketplace payments, subscription payments (recurrent billing support) and mobile app integration. Stripe easily integrates with a variety of ecommerce platforms.

Stripe enables ecommerce merchants to build offline POS experiences and thus unifies offline and online payments into a single omnichannel system. Stripe accepts multi-currency payments in 135+ international currencies and also supports ACH and Bitcoin payment processing. Stripe also offers custom coupons for discounts.

Cons

Long dispute management cycles

Not available in many countries (operates in 42 countries worldwide)

Fees And Charges

2% for cards issued in India

3% for cards issued outside India

1% for instant payouts

Authorize.net

Authorize.net is one of the oldest and thebest international payment gateways for small merchants. It promotes itself as a “small business payment solution”. It offers an extremely flexible and easily customizable payment gateway solution for international businesses.

Pros

Authorize.net international payment gateway has different fee structures based on the 2 plans, i.e; a gateway-only plan and a gateway + merchant account plan. They do charge setup and monthly fees and also have charges per transaction.

Authorize.net international payment gateway solutions can be used for doing business in the United States, Canada, United Kingdom, Europe, and Australia. Authorize.net has a strong simple checkout and support for recurrent billings. It also supports eCheck processing and has a strong fraud protection mechanism to safeguard the interests of the merchants.

Cons

Accepts international payments only for businesses based in US, UK, Canada, Europe, and Australia

Not available in many countries

Fees And Charges

All-in-One option

No setup fee

Monthly gateway: $25

Per transaction 2.9% + 30¢

Payment Gateway Only

No setup fee

Monthly gateway: $25

Per transaction 10¢, daily batch fee 10¢

ANZ

ANZ can be a good international payment gateway for Indian merchants. The ANZ online payment system is one of the best payment gateways worldwide as it allows merchants to receive payments online, in-app and over the phone. ANZ offers payment gateway as well as merchant account services.

Depending on your business size and requirements you can go with any of theflexible plans offered by ANZ payment gateway. Its advanced online paymentsystems enables businesses to accept recurring and scheduled payments, get multiple options for customization and integration and also offers the ability to use tokenisation.

Pros

Easy setup and highly secure online payment systems

Seamless integrations with merchant accounts and many ecommerce platforms

Customers can pay from anywhere in the world using their mobile devices

Cons

Expensive compared to other international payment gateways providers

Some merchants complain that the customer service is not as desired

Not compatible with some popular ecommerce shopping carts and website builders

Fee And Charges

ANZ international payment gateway offers flexible and custom pricing based on merchant requirements. It has different plans and pricing rates as below:

Startup Plan: Charges lesser fees for the first 12 months

Business Select Plan: Custom fees for businesses of different sizes

Community Select Packages: Designed for community and nonprofit groups. Customized deals and have waived off establishment fees, monthly fees, annual fees etc.

ANZ International Payment Gateway Pricing Rates For Different Cards

Single Rate Pricing: Suits small and medium businesses where they pay a single rate for all types of cards

Differential Rate Pricing: Suits medium businesses where different rates are charged for different cards

Interchange Plus Pricing: Suitable for large enterprise businesses that prefer variable pricing, based on interchange prices set by different card schemes

Interchange Plus and International Blended pricing: Suitable for large businesses that need variable pricing based on domestic interchange prices set by each of the card schemes and International Rates and Union Pay Rates set by ANZ

Checkout.com

Checkout has made it to StoreHippo recommended international payment gateway list due to its various merits. It offers an all-in-one solution that offers easy and secure online payment solutions for businesses planning a global presence.

Pros

To begin with, it allows hassle-free setup, quick processing and multiple payment options for global as well as domestic transactions. Checkout.com offers innovative payment solutions for 150+ currencies and 20+ currencies. They have developer-friendly APIs which ensure seamless integration. The modular infrastructure of their international payment gateway enables businesses to choose the solutions which best fits their needs.

They offer options for easy online and mobile payments, various Ecommerce plugins, debit cards and net banking support apart from regular credit card processing. They also offer recurring billing which makes it simpler for customers as well as merchants to process repeat orders and implement subscription-based pricing.

Checkout.com international payment gateway offers different plans and pricing structures for global merchants based on transaction volume, history and card type. they offer two plans, namely Enterprise and Standard.

Cons

- Difficult coding for server-side set-up

- Filtering issues for transactions in the merchant admin panel

- Some merchants have reported about blocked funds

Fee And Charges:

Plans:

Enterprise

Standard

Flat rates based on business profile and risk category

Worldpay (Now known as FIS)

Worldpay has been on StoreHippo’s best international payment gateways list due to the ease of payments and security it offers to merchants as well as the customers. Worldpay offers international payment solutions for all types of businesses which includes B2B and B2C large enterprise businesses, Omnichannel commerce payment solutions, as well as small and medium businesses.

Pros

Worldpay international payment gateway offers payment solutions in two forms, hosted pay page and integration payment page. In the hosted page option Worldpay provides merchants with a payment page whereas in the integrated option the payment page is integrated with merchant’s checkout page. Both models have flexible payment plans which help in accepting a variety of payments from international customers.

Worldpay payment gateway allows merchants to accept payments in 126+ currencies along with accepting email and phone payments in 146 countries worldwide. They also enable merchants to set up recurring or subscription-based payment plans for regular customers. Refunds are easy and convenient and pricing plans are pretty easy to understand.

Worldpay also has a very strong system to mitigate fraud through its integrated fraud screening and alert system. It has made it to our top 11 international payment gateway list as it offers a very convenient, easy and PCI DSS compliant way to manage online international transactions.

Cons

Hidden charges reported by many merchants

The support is helpful but getting connected and right answers are time-consuming

Fee And Charges

WorldPay international payment gateway has the following pricing options:

Gateway Standard - £19/month, transaction limit- 350, no setup fee, and other Visa, PayPal, and digital payment checkouts

Advanced Gateway- £45/month, transaction limit- 850 transactions + additional support for international payments and other payment options

Paytm Payment Gateway

Paytm is a popular online payment system for Indian merchants and it also offers international payment gateway solution for Indian merchants. The Paytm app makes it convenient for customers to send payments using a variety of options like credit and debit cards, Netbanking, Paytm wallet and more.

Pros

Paytm Payment Gateway offers instant, online onboarding and merchants can start accepting secure payments through Paytm in relatively less time compared to other payment channels. It is easy for businesses to create personalised checkout experiences for their customers on multiple channels using Paytm’s mobile SDKs, ready-to-use JS snippets and powerful APIs.

Paytm digital payment solutions is also unique in the sense that it is the only payment gateway that does not levy a charge on UPI transactions. It offers 0% MDR (merchant discount rate) on UPI and RuPay debit cards. Paytm is also good for high-volume businesses as it supports 2,500 transactions per second.

Using Paytm’s International Payment Gateway Indian businesses can accept international payments from over 200 countries in all major currencies. While using Paytm’s international payment gateway Indian merchants can sell their products globally without the need for any additional API integration.

Cons

- Some merchants report that Paytm has a slow support

- Merchant have to pay some charges to transfer money form paytm wallet to another account

Fee And Charges

Merchants need to pay one-time set-up fees to set up their international payment gateway with Paytm. Also, they have to pay annual maintenance charges. Paytm also takes integration charges for integrating Paytm with a website or app. Up to 4% of MDR is levied on total purchase value before remitting the funds to the merchant’s bank account.

UPI – Standard -0%

UPI – Subscription-Rs. 5 per mandate*

Credit Cards-1.99%

Debit CardsRupay – 0%

Mastercard and VISA – 0.4% for transaction amount below Rs. 2000; 0.9% for amount greater than Rs. 2,000

Paytm Wallet-1.99%

Net Banking-1.99%

International Payment Gateway- 2.8%

Telr

Telr is one of the Dubai based international payment gateways providers known for the ease of integration with a host of popular ecommerce platforms and shopping carts. It also offers an API for the mobile app.

Pros

Telr online payment systems offer a secure platform to accept payments online using the most popular networks like Visa, MasterCard, American Express and many others. Merchants using Telr payment gateway worldwide can accept multi-currency, multi-country payments, recurring payments and use QR codes to send customers to an online payment page. Payments can also be accepted through messaging apps.

Telr online payments systems have proprietary anti-fraud software which makes it one of the best online payment systems. You can easily integrate your online store with Telr and become PCI DSS compliant automatically as the payment gateway is PCI DSS Level 1 certified. It also allows businesses to set up customisable processing rules.

Cons

Some merchants have complained about funds being held for a long time

Slow support

Fee And Charges

Telr offers a tiered pricing plan namely, Entry Plan, Small Plan and Medium Plan based on the monthly transaction value. If your transactions cross the upper limit you are automatically upgraded to the next plan in the coming month.

Entry Plan (order volume AED 0-20000/month)- AED 349/month

Small Plan (order volume AED 20001-50000/month)- AED 149/month + 2.69% transaction fees+ AED 1/transaction

Medium Plan (order volume above AED 50001/month)- AED 99/month + 2.49% transaction fees+ AED 0.50/transaction

HyperPay

HyperPay is one of the best international payment gateways for businesses in the MENA region. It allows businesses to process local, regional as well as global cashless payments in a secure and customer-friendly environment.

Pros

HyperPay can be integrated easily with a host of ecommerce platforms. Merchants can enable fast one-click payments. Recurring subscription-based payments are also made easy using tokenization. Also, payments and checkout customization are easy to manage. HyperPay international payment gateway also offers customized invoices.

HyperPay also offers invoicing services for easy billing management. Advanced fraud protection using a combination of risks, settings, machine learning and analytics helps prevent frauds.

HyperPay makes it to the top 10 international payment gateways list of StoreHippo as along with other benefits, it also offers a mobile app to monitor the business on the go. Using the HyperPay mobile app business owners can stay connected 24/7, access their dashboard, monitor transactions and take necessary actions without any delay.

Cons

Some merchants complain that their support is slow

Not all merchants need the advanced features for which they have to pay

Fee And Charges

- Custom prices based on business size, the volume of transactions, risk assessment etc.

senangPay

senangPay is the last but one of the most popular entrants in StoreHippo’s updated international payment gateway list. It allows merchants to accept payments through credit and debit cards, net banking, e-wallets, chat or messenger apps and social media platforms like Facebook and Instagram.

Pros

senangPay’s international payment gateway has partnered with Stripe to offer multi-currency payments in 7+ currencies(with plans to add many more). They also offer merchants’ brand names on all billing records for international payments. senangPay international payment gateway has also added an e-wallet facility for free for all Advance, Special Package and Stripe MYR subscribers.

senangPay’s online payment systems special package offers a lower transaction rate than other plans rates for credit and debit card transactions. Also, senangPay online payment gateway system allows recurring payments and split settlements for your sellers. It also helps merchants store card details securely for fast and easy checkouts.

Along with these merchants can get the benefits like multiple payments in one batch, twice-weekly automatic settlements without any fees, customizable invoices for requesting payments from merchants’ customers and a facility for receiving e-wallet payments.

Cons

Some merchants complain of long waiting times for mail replies

A long list of prohibited items

Fee And Charges

senangPay international payment gateway has a different TDR rate for debit and credit cards transactions which is higher than the rate for net banking or FPX transactions and e-wallet payments. They are open to discussing lower/customized rates for businesses that think they deserve a lower TDR rate than stipulated.

Following are the different plans under which they offer different rates for local and foreign credit and debit cards. Their FPX and e-wallet also have the same plans but with different rates which are subject to change.

Basic

Advanced

Special

Stripe MYR

Stripe Multicurrency

Conclusion

The above comprehensive international payment gateways list will help you decide the most suitable payment gateways for your global ecommerce business. Experts suggest it is always good to spoil your customers for choice when it comes to payment choices. Ensuring simple and frictionless checkout is known to boost ecommerce conversions manifold

It is always better to go through the completepayment gateway list and make an informed decision about the payment processor most suited for your business. StoreHippo offers quick and easypre-integration with all the above payment gateways needed for an international ecommerce business.

Check out the complete list of payment processors integrated with StoreHippo at our Payment Gateway page. Learn more about theunique advantages of Storehippo Payment Gateway integration with our detailed article.

Need to know more about the best international payment gateways for your business? Schedule a free demo with our experts right away!

International Payment Gateways FAQs

StoreHippo brings detailed answers to FAQs related to international payment gateways, different types of payment processing systems, transaction terms used by payment processors and more.

Check out the detailed answers given below:

1) What is a Payment Gateway?

A Payment Gateway or a Payment Service Provider (PSP) is an online payment service that helps ecommerce businesses receive digital payments from their customers. A payment service provider ensures secure money transfer from the customers’ to the merchants’ bank account.

Payment gateways are integrated with ecommerce platforms to form a digital channel for receiving electronic payments. Online payments can be made using credit and debit cards, bank transfers, payment wallets etc.

In other words, a payment gateway is the software equivalent of a Point Of Sale (POS) terminal of a real store. It completes the sales process on an online store by securely charging the customers who buy from ecommerce stores.

2) What is an international Payment Gateway?

An international payment gateway is a payment system that enables businesses to accept payment from international customers in their preferred currency. The international payment gateways process payments in multiple currencies. By making international payments easy and frictionless global payment processors help in boosting the order volume and reach of ecommerce brands. All international payment gateways adhere to strict and multi-level security protocols to prevent any fraud and ensure secure payment channels for merchants and customers.

3) How does a Payment Gateway work?

At the customer level, the functioning of the payment gateways is simple and straightforward. At the checkout of the ecommerce store, the customer adds his credit card or debit card details. Then he/she requests an OTP( One Time Password) in real-time and makes the payment by entering the code which is used to authorize the payment over a secure line.

However, the seemingly simple process is a chain of complex steps at the other end. Let’s see how the payment is processed in the background;

Step 1: Customer enters his/her card details on the online portal. Online transactions are processed as “card-not-present” as there is no real card to do a magnetic reading.

Step 2: Once the card info is submitted, it is encrypted and sent to the merchant’s payment gateway.

Step 3: The payment processor further routes the encrypted data to the credit/ debit card service provider like; Visa, MasterCard, American Express etc. These service providers charge a fee for each transaction.

Step 4: This step involves the authorization of the card. After checking whether the card is valid, holds a valid fund, is within the permissible transaction limit etc. the transaction is authorized.

Step 5: Once the transaction becomes authorized, as an additional security measure the issuing bank sends an OTP to the customer’s registered mobile number. When the customer enters this OTP the authorization starts.

Step 6: Once the card-issuing bank authorizes the process it transmits the details back to the other parties, viz; the issuing card association, the merchant’s bank and finally the ecommerce website on which the payment was initiated through the payment gateway.

Step 7: All of the above processes take place within a few seconds. However, it might take a few hours for the funds to actually reflect in the merchant’s account.

Well, the whole process looks rather complex but the flow at the bestpayment gateway level is streamlined in a way that it happens quickly and smoothly in a few seconds over a secure channel.

4) What are the different types of Payment Gateways?

Growing penetration of internet and mobile phones coupled with the ease of paying online has given rise to online transactions. eWallets remain the preferred payment channel of online shoppers by accounting for 51.7% of global online payments. This is followed by credit cards at 20.8% and debit cards at 12% (Source:Statista).

However, to use any of these methods, online stores need to be integrated with a payment gateway. These payment processors can be of many different types as given below:

Hosted Payment Gateways

These payment processors direct the customers from the ecommerce site’s checkout page to the payment service provider page. The customer fills his card details here and after the payment is done the customer is redirected back to the ecommerce store.

The most popular example of such a payment processor is PayPal.

Self-Hosted Payment Processor

In this payment system the customer fills all his payment/card details within the ecommerce portal. The data is then encrypted with a hash key or in a specific format and then passed over to the payment processor’s URL.

For example, Stripe and Authorize.net power such payment processes for their merchants.

- API Hosted Payment Gateways

Sometimes the ecommerce merchants want full control on their online store. In such cases, API hosted gateways can be used. In this setup, customers enter their card details on the online store’s checkout page and the payment processing is done using API or HTTPS queries.

Stripe, Authorize.net CIM offers such services.

Direct Payment Gateway

In this setup, the customer’s profile is created with the processor. The payment done is not deducted instantly but at a scheduled time. The merchant is just informed whether the card is approved or not. The merchant keeps making a periodic enquiry with the processor to ensure whether the final transaction has been done successfully.

This type of payment gateways support fixed and recurring payments. Example; Payflow Pro

Local Bank Integration

This is similar to hosted payment processors. The customer is redirected from the ecommerce portal to the bank’s website where they provide their payment details. After making the payment they are redirected to the online store along with their payment notification data.

All major banks like ICICI, HDFC, IDBI offer such ePayment processing services.

Platform-Based Payment Solutions

In this system, the payment processors offer the dual service of payment processing along with providing a platform to sell goods and services using their server. Merchants can upload their products on the given platform and customers are sent to the payment platform when they click the checkout.

Digital Wallets

This form of digital payments has become very popular in the last few years. The customer is required to set up an account with the service provider and then add money to his digital wallet using his credit or debit card. Now users can pay directly from their digital wallet without needing approval from their bank, credit card processor etc.

Paytm is the most popular example of this type of online payment wallet.

5) What are the different Payment Gateway transaction terms and their meaning?

Following are the most important terminologies used by payment processors worldwide:

TDR% (Transaction Discount Rate % )

This is the charge paid by the merchant to the payment gateway provider for each transaction. This amount is deducted from every transaction and the remaining amount is transferred to the merchant’s account.

This percentage may vary depending on the monthly sales volume, the average order size, and whether a transaction is processed with or without the card being physically present.

Payment Gateway Fee

This is the fee charged by the payment processor forreceiving and processing the transaction on behalf of the merchant.Gateway fee is basically the charge for using the infrastructure of the payment processor which includes receiving payment information, the authorization request, transmitting the authorization information back to the merchant and facilitating the payment to the merchant.

Refund

Refund is reversing a payment made by a customer to the ecommerce merchant. If a customer does not like the product or services or has ordered by mistake(as in case of double order) he/she can request a refund for the purchase amount.

Payment gateways levy a small amount as refund charges from the ecommerce merchant for refunding the money back to the customer.

Chargeback

A chargeback is a scenario when a customer contests the charge made on his card. In this scenario, the issuing bank issues a chargeback and reverses the amount to the customer.

This can happen if the card details are stolen, the customer is angry due to delay in delivery or simply because the customer has an intent to defraud.

Ecommerce merchants should issue a refund to unhappy customers to prevent a chargeback. Payment gateways consider too many chargebacks as a red flag for the given merchant account. The chargeback fee is usually much higher than the refund fee and the merchant has to bear this cost. Merchants can also be penalised if there are chargebacks beyond an acceptable threshold set by the payment gateway.

6) What are the charges of using a Payment Gateway?

Payment gateways charge a one-time setup fee from the merchant. Also, there is a processing charge for each transaction which is charged on a percentage basis for each transaction. Some of the gateways offer free set up but they charge a higher percentage of transaction fee per transaction. Some may also have a monthly fee.

7) What is a merchant account?

A merchant account is a bank account for a business. To use the services of a payment gateway you need to start a merchant account with them. The merchant account enables the business to accept payments using a credit or debit card. The payment gateway uses your merchant account to securely transfer electronic payments made by your customers to your account.

8) What is settlement time in Payment Gateway?

Payment gateways have a certain wait period for finally transferring the transaction amount to a business or merchant account. This time is called settlement time. Payment gateways deduct their charges before transferring the final settlement amount in the merchant's bank account. Payment gateways follow different models for settling the payments for different categories of merchants.

9) What is a PCI compliant Payment Gateway?

The PCI DSS or Payment Card Industry Data Security Standard is a set of requirements designed to ensure a secure environment for companies that process, store or transmit credit card. A PCI DSS compliant payment gateway ensures the security of online card transactions and protects any sensitive financial information of the users from being stolen.

10) What are the benefits of using multiple Payment Gateways on your ecommerce website?

Offering multiple payment options to customers is known to boost conversions. Some of the other benefits of using multiple digital payments services on ecommerce stores are:

Centralised payment system and clarity of income for the business owner

Frees business owners from the hassle of collecting payments and managing them

Offers flexibility as a business owner can benefit from the diverse features and offers of various payment providers

Allows to offer customized checkout flow and special discounts to customers who use a preferred payment channel

Gives convenience and ease of paying in a few clicks to the customers

Using trusted and secure payment channels boost customer trust

Multiple payment options improve customer retention

Having multiple payment channels on your ecommerce store portrays you as a professional and popular business

Offers a backup payment channel in case some of the payment systems are out of service for some time

Helps in expanding to international markets when you use international payment gateways that handle multi-currency payments